Gemanagte Portfolios - Stuttgarter

Der Stuttgarter FONDSPiLOT navigiert Sie sicher zur passenden fondsgebundenen Altersvorsorge.

Der FONDSPiLOT ermittelt Ihr Anlegerprofil und ein dazu passendes gemanagtes Portfolio. Er steuert das gewählte Portfolio automatisch mit SAM, dem Stuttgarter Automatischen Management: ein bislang im Versicherungsmarkt einzigartiger Algorithmus, speziell für den langfristigen Anlagehorizont einer Altersvorsorge entwickelt. Er überprüft das Portfolio und passt die Zusammensetzung bei sich verändernden Märkten während der gesamten Vertragslaufzeit an Ihr Risikoprofil an – und das kostenfrei.

Die Stuttgarter gemanagten Portfolios für eine verlässliche Altersvorsorge.

Die gemanagten Portfolios der Stuttgarter setzen sich aus bis zu 13 Investmentfonds, größtenteils kostengünstige Indexfonds (ETF) zusammen. Sie bilden alle wichtigen Anlageklassen weltweit ab. Es erfolgt eine automatische Anpassung der Portfolios über einen von der Stuttgarter entwickelten Algorithmus. Dieser berücksichtigt den langfristigen Anlagehorizont einer Altersvorsorge und passt die Zusammensetzung der Portfolios regelmäßig an. Das Ziel ist, das Risikoprofil der Portfolios langfristig stabil zu halten.

ESG-Portfolios legen Wert auf ökologische, soziale oder ethische Aspekte

Wünschen Kunden gemanagte Portfolios, die ökologische, sozial oder ethische Grundsätze berücksichtigen, sind die ESG-Portfolios erste Wahl. Die Anlagepolitik der enthaltenen Fonds und ETFs erfolgt nach ESG-Kriterien (ESG: „Environmental“, „Social“, „Governance“) oder Ansätzen des ethischen Investments („SRI“: Socially Responsible Investment). Zudem sind Fonds mit Fokus auf Branchen mit ökologischer, sozialer oder ethischer Wirkung (z.B. Wasser, Gesundheitswesen, erneuerbare Energien) enthalten

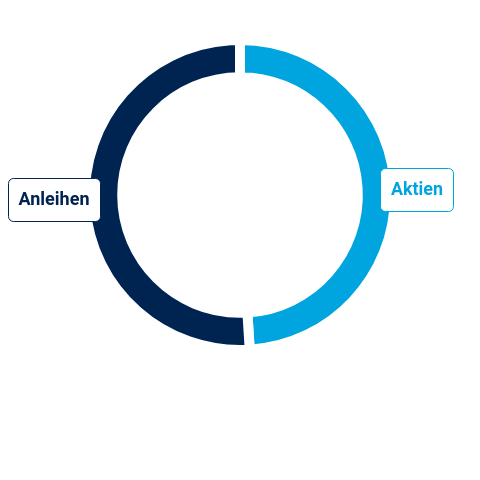

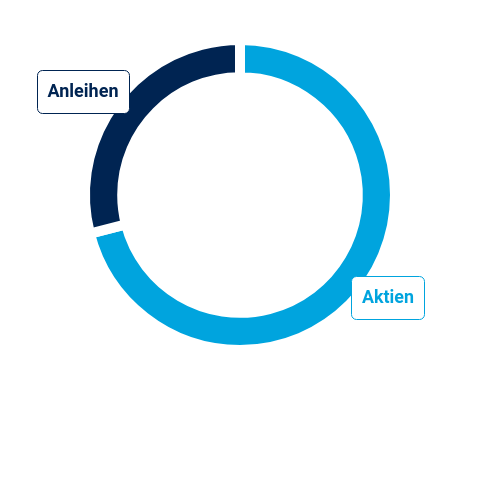

| Aktien (49%) | ||

| Xtrackers MSCI Europe UCITS ETF 1C (EUR) | 14,92% | |

| Xtrackers MSCI USA UCITS ETF 1C | 14,88% | |

| iShares Core MSCI Japan IMI UCITS ETF | 7,40% | |

| Xtrackers MSCI Pacific ex Japan Screened UCITS ETF 1C | 6,82% | |

| Xtrackers MSCI World Health Care UCITS ETF 1C (EUR) | 1,11% | |

| Dimensional Global Small Companies Fund EUR Acc | 1,05% | |

| iShares Core MSCI Emerging Markets IMI UCITS ETF | 0,84% | |

| Xtrackers MSCI World Consumer Discretionary UCITS ETF 1C (EUR) | 0,78% | |

| Fidelity Funds - Global Technology Fund Y-ACC-EUR | 0,76% | |

| iShares MSCI India UCITS ETF | 0,42% |

| Anleihen (51%) | ||

| Amundi Euro Government Inflation-Linked Bond UCITS ETF Acc | 17,01% | |

| iShares $ Short Duration Corp Bond UCITS | 17,01% | |

| iShares Global Aggregate Bond UCITS ETF EUR Hedged (Acc) | 17,00% |

| Aktien (71%) | ||

| Xtrackers MSCI Europe UCITS ETF 1C (EUR) | 19,39% | |

| Xtrackers MSCI USA UCITS ETF 1C | 19,34% | |

| iShares Core MSCI Japan IMI UCITS ETF | 9,61% | |

| Xtrackers MSCI Pacific ex Japan Screened UCITS ETF 1C | 8,87% | |

| Dimensional Global Small Companies Fund EUR Acc | 4,50% | |

| iShares Core MSCI Emerging Markets IMI UCITS ETF | 3,59% | |

| iShares MSCI India UCITS ETF | 1,78% | |

| Xtrackers MSCI World Health Care UCITS ETF 1C (EUR) | 1,64% | |

| Xtrackers MSCI World Consumer Discretionary UCITS ETF 1C (EUR) | 1,15% | |

| Fidelity Funds - Global Technology Fund Y-ACC-EUR | 1,12% |

|

Anleihen (29%) |

||

| Amundi Euro Government Inflation-Linked Bond UCITS ETF Acc | 9,67% | |

| iShares $ Short Duration Corp Bond UCITS | 9,67% | |

| iShares Global Aggregate Bond UCITS ETF EUR Hedged (Acc) | 9,67% |

| Aktien (91%) | ||

| Xtrackers MSCI Europe UCITS ETF 1C (EUR) | 21,84% | |

| Xtrackers MSCI USA UCITS ETF 1C | 21,78% | |

| iShares Core MSCI Japan IMI UCITS ETF | 10,82% | |

| Xtrackers MSCI Pacific ex Japan Screened UCITS ETF 1C | 9,99% | |

| Dimensional Global Small Companies Fund EUR Acc | 7,59% | |

| iShares Core MSCI Emerging Markets IMI UCITS ETF | 6,06% | |

| Xtrackers MSCI World Health Care UCITS ETF 1C (EUR) | 4,17% | |

| iShares MSCI India UCITS ETF | 3,01% | |

| Xtrackers MSCI World Consumer Discretionary UCITS ETF 1C (EUR) | 2,91% | |

| Fidelity Funds - Global Technology Fund Y-ACC-EUR | 2,83% |

| Anleihen (9%) | ||

| Amundi Euro Government Inflation-Linked Bond UCITS ETF Acc | 3,00% | |

| iShares $ Short Duration Corp Bond UCITS | 3,00% | |

| iShares Global Aggregate Bond UCITS ETF EUR Hedged (Acc) | 3,00% |

| Aktien (100%) | ||

| Xtrackers MSCI Europe UCITS ETF 1C (EUR) | 20,73% | |

| Xtrackers MSCI USA UCITS ETF 1C | 20,65% | |

| Dimensional Global Small Companies Fund EUR Acc | 10,34% | |

| iShares Core MSCI Japan IMI UCITS ETF | 10,26% | |

| Xtrackers MSCI Pacific ex Japan Screened UCITS ETF 1C | 9,47% | |

| iShares Core MSCI Emerging Markets IMI UCITS ETF | 8,25% | |

| Xtrackers MSCI World Health Care UCITS ETF 1C (EUR) | 6,81% | |

| Xtrackers MSCI World Consumer Discretionary UCITS ETF 1C (EUR) | 4,76% | |

| Fidelity Funds - Global Technology Fund Y-ACC-EUR | 4,63% | |

| iShares MSCI India UCITS ETF | 4,10% |

| Aktien (100%) | ||

| Xtrackers MSCI Europe UCITS ETF 1C (EUR) | 17,43% | |

| Xtrackers MSCI USA UCITS ETF 1C | 17,37% | |

| Dimensional Global Small Companies Fund EUR Acc | 12,35% | |

| iShares Core MSCI Emerging Markets IMI UCITS ETF | 9,85% | |

| Xtrackers MSCI World Health Care UCITS ETF 1C (EUR) | 9,04% | |

| iShares Core MSCI Japan IMI UCITS ETF | 8,64% | |

| Xtrackers MSCI Pacific ex Japan Screened UCITS ETF 1C | 7,97% | |

| Xtrackers MSCI World Consumer Discretionary UCITS ETF 1C (EUR) | 6,31% | |

| Fidelity Funds - Global Technology Fund Y-ACC-EUR | 6,14% | |

| iShares MSCI India UCITS ETF | 4,90% |

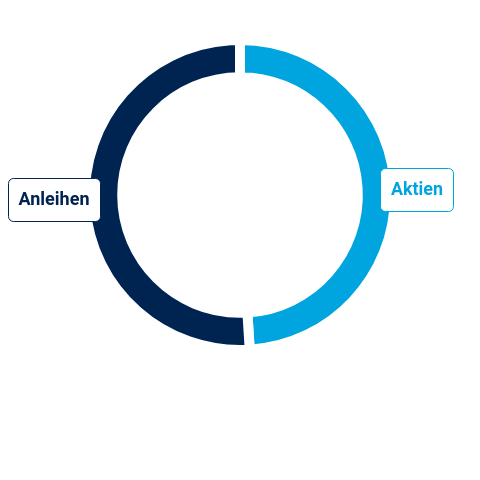

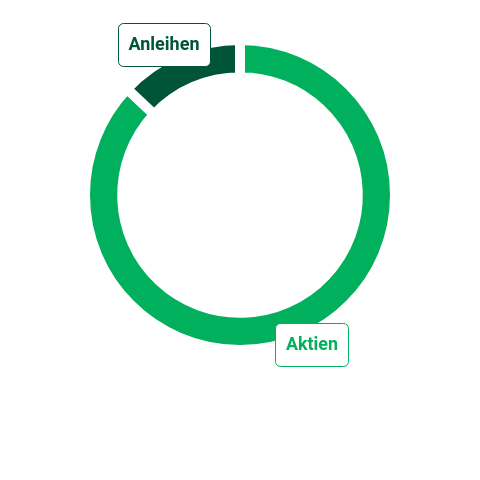

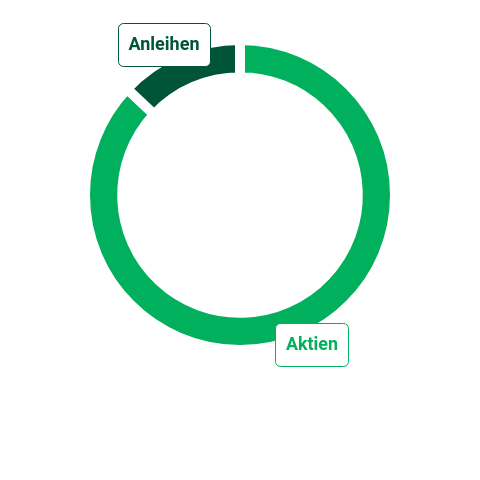

Portfolio 1

| Aktien (49%) | ||

| Xtrackers MSCI Europe UCITS ETF 1C (EUR) | 14,92% | |

| Xtrackers MSCI USA UCITS ETF 1C | 14,88% | |

| iShares Core MSCI Japan IMI UCITS ETF | 7,40% | |

| Xtrackers MSCI Pacific ex Japan Screened UCITS ETF 1C | 6,82% | |

| Xtrackers MSCI World Health Care UCITS ETF 1C (EUR) | 1,11% | |

| Dimensional Global Small Companies Fund EUR Acc | 1,05% | |

| iShares Core MSCI Emerging Markets IMI UCITS ETF | 0,84% | |

| Xtrackers MSCI World Consumer Discretionary UCITS ETF 1C (EUR) | 0,78% | |

| Fidelity Funds - Global Technology Fund Y-ACC-EUR | 0,76% | |

| iShares MSCI India UCITS ETF | 0,42% |

| Anleihen (51%) | ||

| Amundi Euro Government Inflation-Linked Bond UCITS ETF Acc | 17,01% | |

| iShares $ Short Duration Corp Bond UCITS | 17,01% | |

| iShares Global Aggregate Bond UCITS ETF EUR Hedged (Acc) | 17,00% |

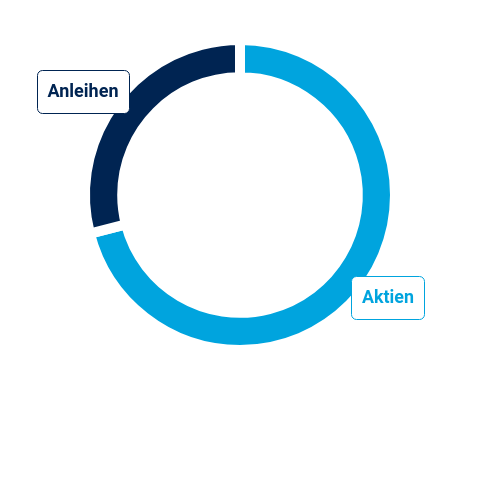

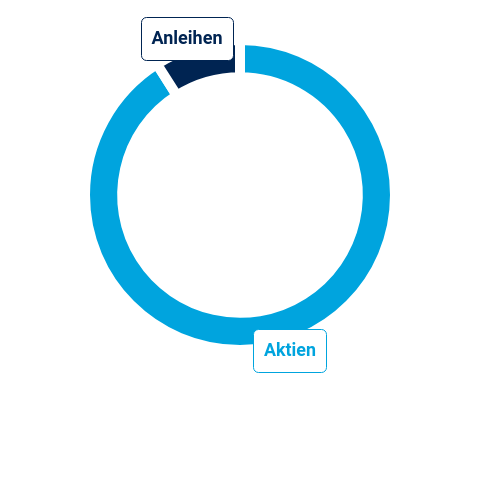

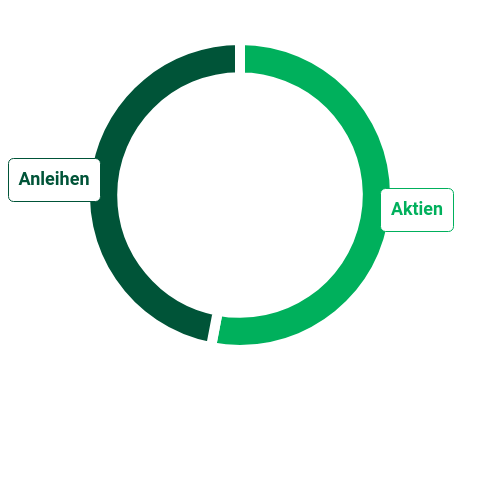

Portfolio 2

| Aktien (71%) | ||

| Xtrackers MSCI Europe UCITS ETF 1C (EUR) | 19,39% | |

| Xtrackers MSCI USA UCITS ETF 1C | 19,34% | |

| iShares Core MSCI Japan IMI UCITS ETF | 9,61% | |

| Xtrackers MSCI Pacific ex Japan Screened UCITS ETF 1C | 8,87% | |

| Dimensional Global Small Companies Fund EUR Acc | 4,50% | |

| iShares Core MSCI Emerging Markets IMI UCITS ETF | 3,59% | |

| iShares MSCI India UCITS ETF | 1,78% | |

| Xtrackers MSCI World Health Care UCITS ETF 1C (EUR) | 1,64% | |

| Xtrackers MSCI World Consumer Discretionary UCITS ETF 1C (EUR) | 1,15% | |

| Fidelity Funds - Global Technology Fund Y-ACC-EUR | 1,12% |

|

Anleihen (29%) |

||

| Amundi Euro Government Inflation-Linked Bond UCITS ETF Acc | 9,67% | |

| iShares $ Short Duration Corp Bond UCITS | 9,67% | |

| iShares Global Aggregate Bond UCITS ETF EUR Hedged (Acc) | 9,67% |

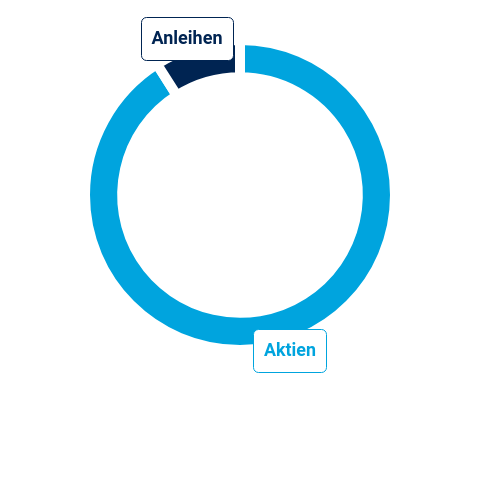

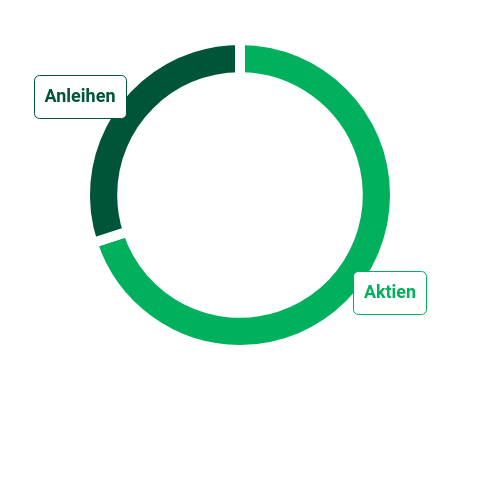

Portfolio 3

| Aktien (91%) | ||

| Xtrackers MSCI Europe UCITS ETF 1C (EUR) | 21,84% | |

| Xtrackers MSCI USA UCITS ETF 1C | 21,78% | |

| iShares Core MSCI Japan IMI UCITS ETF | 10,82% | |

| Xtrackers MSCI Pacific ex Japan Screened UCITS ETF 1C | 9,99% | |

| Dimensional Global Small Companies Fund EUR Acc | 7,59% | |

| iShares Core MSCI Emerging Markets IMI UCITS ETF | 6,06% | |

| Xtrackers MSCI World Health Care UCITS ETF 1C (EUR) | 4,17% | |

| iShares MSCI India UCITS ETF | 3,01% | |

| Xtrackers MSCI World Consumer Discretionary UCITS ETF 1C (EUR) | 2,91% | |

| Fidelity Funds - Global Technology Fund Y-ACC-EUR | 2,83% |

| Anleihen (9%) | ||

| Amundi Euro Government Inflation-Linked Bond UCITS ETF Acc | 3,00% | |

| iShares $ Short Duration Corp Bond UCITS | 3,00% | |

| iShares Global Aggregate Bond UCITS ETF EUR Hedged (Acc) | 3,00% |

Portfolio 4

| Aktien (100%) | ||

| Xtrackers MSCI Europe UCITS ETF 1C (EUR) | 20,73% | |

| Xtrackers MSCI USA UCITS ETF 1C | 20,65% | |

| Dimensional Global Small Companies Fund EUR Acc | 10,34% | |

| iShares Core MSCI Japan IMI UCITS ETF | 10,26% | |

| Xtrackers MSCI Pacific ex Japan Screened UCITS ETF 1C | 9,47% | |

| iShares Core MSCI Emerging Markets IMI UCITS ETF | 8,25% | |

| Xtrackers MSCI World Health Care UCITS ETF 1C (EUR) | 6,81% | |

| Xtrackers MSCI World Consumer Discretionary UCITS ETF 1C (EUR) | 4,76% | |

| Fidelity Funds - Global Technology Fund Y-ACC-EUR | 4,63% | |

| iShares MSCI India UCITS ETF | 4,10% |

Portfolio 5

| Aktien (100%) | ||

| Xtrackers MSCI Europe UCITS ETF 1C (EUR) | 17,43% | |

| Xtrackers MSCI USA UCITS ETF 1C | 17,37% | |

| Dimensional Global Small Companies Fund EUR Acc | 12,35% | |

| iShares Core MSCI Emerging Markets IMI UCITS ETF | 9,85% | |

| Xtrackers MSCI World Health Care UCITS ETF 1C (EUR) | 9,04% | |

| iShares Core MSCI Japan IMI UCITS ETF | 8,64% | |

| Xtrackers MSCI Pacific ex Japan Screened UCITS ETF 1C | 7,97% | |

| Xtrackers MSCI World Consumer Discretionary UCITS ETF 1C (EUR) | 6,31% | |

| Fidelity Funds - Global Technology Fund Y-ACC-EUR | 6,14% | |

| iShares MSCI India UCITS ETF | 4,90% |

|

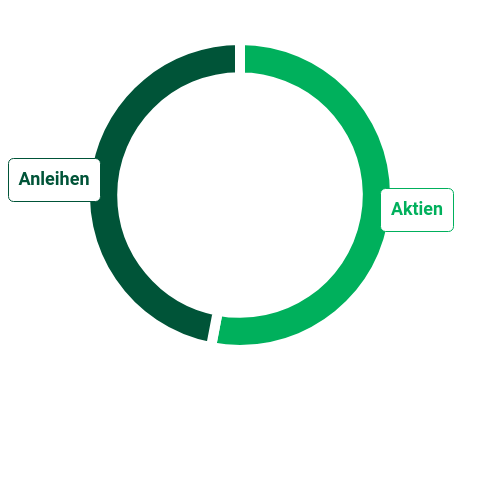

| Aktien (70%) | ||

| Nordea 2 - BetaPlus Enhanced North American Sustainable Equity Fund BI USD | 10,61% | |

| Amundi MSCI Europe SRI Climate Paris Aligned - UCITS ETF DR (C) | 10,37% | |

| Nordea 2 - BetaPlus Enhanced Global Sustainable Small Cap Equity Fund BI USD | 8,83% | |

| Amundi MSCI Emerging Markets SRI Climate Paris Aligned - UCITS ETF DR (C | 7,81% | |

| Robeco Circular Economy I EUR | 5,29% | |

| Robeco Sustainable Water I EUR | 5,10% | |

| Nordea 2 - BetaPlus Enhanced Japanese Sustainable Equity Fund - BI - EUR | 4,97% | |

| Nordea 1 - Global Climate and Environment Fund BI-EUR | 4,75% | |

| DPAM B Equities NewGems Sustainable W | 4,47% | |

| BlackRock Global Funds - Sustainable Energy Fund D2 EUR | 3,90% | |

| HSBC MSCI AC Asia Pacific Ex Japan Climate Paris Aligned UCITS ETF USD | 3,90% |

| Anleihen (30%) | ||

| Candriam Sustainable Bond Euro I EUR Acc | 10,00% | |

| Candriam Sustainable Bond Euro Short Term I Thes. | 10,00% | |

| iShares € Corp Bond ESG Paris-Aligned Climate UCITS ETF EUR (Acc) | 10,00% |

|

|

|||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||

|

|

ESG-Portfolio 1

|

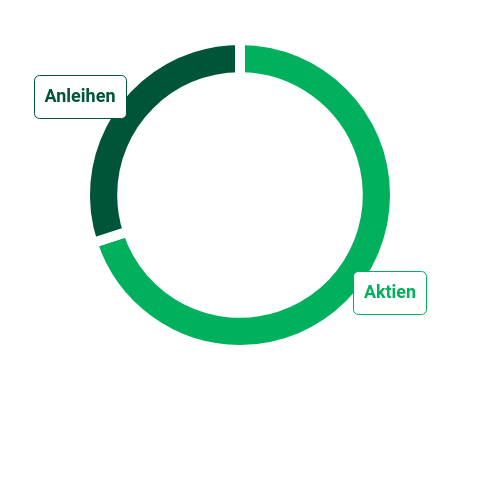

ESG-Portfolio 2

| Aktien (70%) | ||

| Nordea 2 - BetaPlus Enhanced North American Sustainable Equity Fund BI USD | 10,61% | |

| Amundi MSCI Europe SRI Climate Paris Aligned - UCITS ETF DR (C) | 10,37% | |

| Nordea 2 - BetaPlus Enhanced Global Sustainable Small Cap Equity Fund BI USD | 8,83% | |

| Amundi MSCI Emerging Markets SRI Climate Paris Aligned - UCITS ETF DR (C | 7,81% | |

| Robeco Circular Economy I EUR | 5,29% | |

| Robeco Sustainable Water I EUR | 5,10% | |

| Nordea 2 - BetaPlus Enhanced Japanese Sustainable Equity Fund - BI - EUR | 4,97% | |

| Nordea 1 - Global Climate and Environment Fund BI-EUR | 4,75% | |

| DPAM B Equities NewGems Sustainable W | 4,47% | |

| BlackRock Global Funds - Sustainable Energy Fund D2 EUR | 3,90% | |

| HSBC MSCI AC Asia Pacific Ex Japan Climate Paris Aligned UCITS ETF USD | 3,90% |

| Anleihen (30%) | ||

| Candriam Sustainable Bond Euro I EUR Acc | 10,00% | |

| Candriam Sustainable Bond Euro Short Term I Thes. | 10,00% | |

| iShares € Corp Bond ESG Paris-Aligned Climate UCITS ETF EUR (Acc) | 10,00% |

ESG-Portfolio 3

|

ESG-Portfolio 4

|

|||||||||||||||||||||||||||||||||||||

ESG-Portfolio 5

|

||||||||||||||||||||||||||||||||||||||

|

|

Stand: 1. Novermber 2025

Rechtlicher Hinweis: Es handelt sich um eine Werbemitteilung. Bei den Beschreibungen handelt es sich um verkürzte, unverbindliche Darstellungen. Maßgeblich sind ausschließlich die Tarifbestimmungen und die Versicherungsbedingungen. Die FlexRente und die Kindervorsorge sind Versicherungsanlageprodukte. Für diese Versicherungsanlageprodukte gibt es ein gesetzlich vorgeschriebenes Basisinformationsblatt. Es stellt wesentliche Informationen über das Anlageprodukt zur Verfügung. Sie können das Basisinformationsblatt kostenlos bei uns anfordern. Sie finden es auch auf unserer Website unter www.stuttgarter.de/basisinformationsblaetter.